Invoicing in a foreign currency as a freelancer or SMB

When you consider doing business as a freelancer or SMB with customers abroad, you probably wonder if you have to invoice in a foreign currency. The answer is not a simple yes or no. There are laws, benefits and risks you need to consider first…

Table of contents

In this article, we cover the following questions and topics:

Do you have to invoice customers in their currency?

Depending on which country your business and foreign customer are residing in, you can, must or even may not invoice in a foreign currency.

That doesn’t really help you, but it is the reality. As a business owner, it is your sole responsibility to do your homework.

Before you invoice customers abroad, talk with your accountant

This rule of thumb especially applies when you plan to do business with exotic countries. Don’t take this literally, though.

Guatemala may sound exotic to you if you are a German freelancer. But if your business is established in Mexico, for example, it is just a neighbouring country.

Things can get rather complicated.

For example, a business in the UK can invoice a foreign customer in US dollars. But it also has to mention the tax amount in pound sterling.

Again, consult with an accountant, or your local authorities.

The benefit of creating invoices in a foreign currency

Customers want to know how much they actually need to pay you. If you invoice, for instance, a Japanese company in Euros, or US dollars, they need to calculate the exchange rate. Only then will they have a clear idea about how much you charge them in their currency.

Further down, we will give you some tips on how to prevent any confusion before you start doing business with customers abroad.

But for now, it is important to understand:

Customers prefer to pay in their own currency

Don’t you too?

Honestly.

Let’s assume you own a business in Spain and need to choose between two providers. One is from Nigeria and the other one from Vietnam.

The one from Vietnam agrees you pay in euros.

The one from Nigeria wants you to pay in naira.

Which one would you prefer?

Just don’t blindly agree to invoice in any currency, because there is also a risk…

The risk of invoicing in a foreign currency

If you create an invoice in another currency, you and your client risk getting hit by exchange rate fluctuations.

For example:

Your business is registered in the Euro zone and invoices 600 US dollars to a customer.

Today the ratio of dollars versus euro is 1:1.02. That means that you are hoping to receive 612 euros.

However, at the moment your customer pays, the ratio flips in your disadvantage and you will receive only 588 euros.

That’s a difference of 24 euros (highest versus lowest exchange rate).

Not a disaster, but what if…

you only do business with customers abroad and invoice all of them in a foreign currency?

the due amount is several thousands of euros or dollars? With some bad luck, you risk losing much more.

You cannot control exchange rates

You became an entrepreneur because you are brave and ambitious. But you are not a speculative investor.

If you export materials or products, or even deliver services abroad, the exchange rate changes will affect your profit margin.

It can drop below the bottom.

Or skyrocket.

And anything in between.

So, is there any way you can get the best of both worlds?

Happy clients abroad and a happy business bank account?

Let’s find out.

5 best tips for invoicing in your customers’ currency

If you feel insecure about invoicing in another currency, you can apply the following tips:

#1 Get paid upfront

Ask for a (partly) upfront payment. At that moment, both parties know exactly how much their currency is worth. This will also prevent the troubles of reminding customers about payments later on.

#2 Short payment period

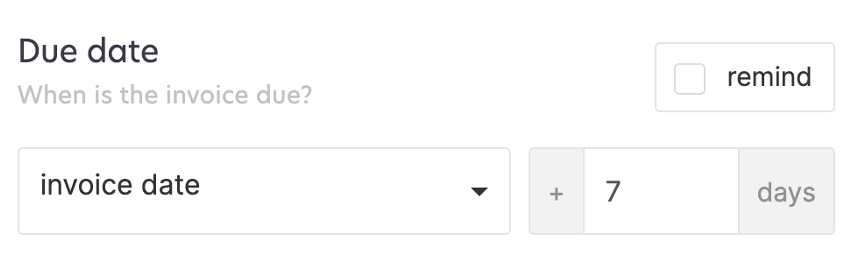

Set the expiration date of your invoice in the near future, but keep it reasonable. 7 days or a fortnight is acceptable.

Alas, nobody can predict how much, for example, the dollar will be worth tomorrow. But at least you will soon find out how responsive the other side is when it comes to paying your invoice.

#3 Agree upon a fixed percentage of the exchange rate

If you want to protect both parties from huge exchange fluctuations, you could agree to fix an acceptable exchange rate.

For example, you can agree that your prices will change if your currency suddenly increases or decreases by 5% compared to the currency of the other party.

It is wise to document how much your currency is worth now. This is the only way to compare changes later on.

Also, agree on which source to use. Money never sleeps. It goes up and down. For the Euro, the website of the European Central Bank is a good reference point. It is updated only once per day. That makes more sense than real time currency exchange rates.

#4 Accept losses and gains

If you are invoicing in foreign currencies regularly, drops and climbs will probably flatten out the differences.

One month, you could earn less in your currency.

Next month, you may earn more in your own currency.

Over a longer period, you will approximately have earned what you wanted.

#5 Open a business bank account in another currency

You can consider opening an extra bank account in another currency. If you are located in the EU, you may, for example, open a business bank account in US dollars. Or the reverse.

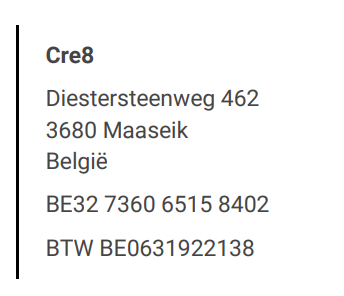

Don’t forget to include your bank account on your invoice, like in this example, to make sure customers transfer money to the right account.

This tip will be much harder if you are located in Germany and most customers want to pay you in yen, the Japanese currency.

Keep in mind that you may have to pay additional fees to open an account in a foreign currency.

Talk with your bank to check your best options.

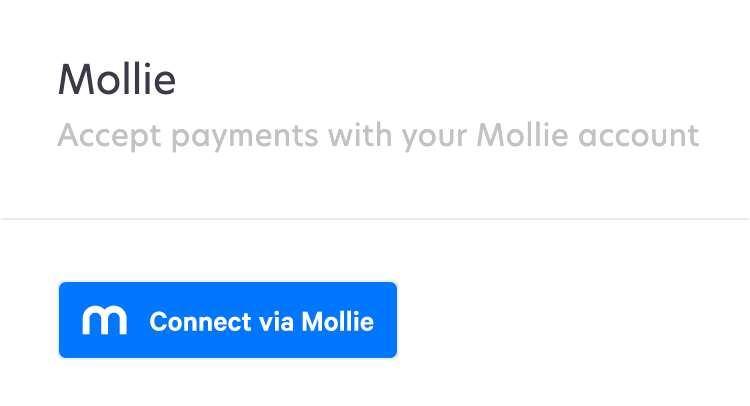

#6 Offer online payments

Even when you don’t run a web shop, you can offer your customers to pay your invoices online. All you need to do is to open an account with an online payment provider.

They will take care of all worries about exchange rates. This is a handy way to keep invoicing in your own currency.

There is, however, a small price you pay. Online payment providers charge a small fee to handle payments securely.

CoManage offers you the option to easily integrate your invoices with Mollie.

This is an established, reliable and affordable option for both you and your customers.

After all these valuable tips and advice, it’s time for action…

How to change your default invoice currency?

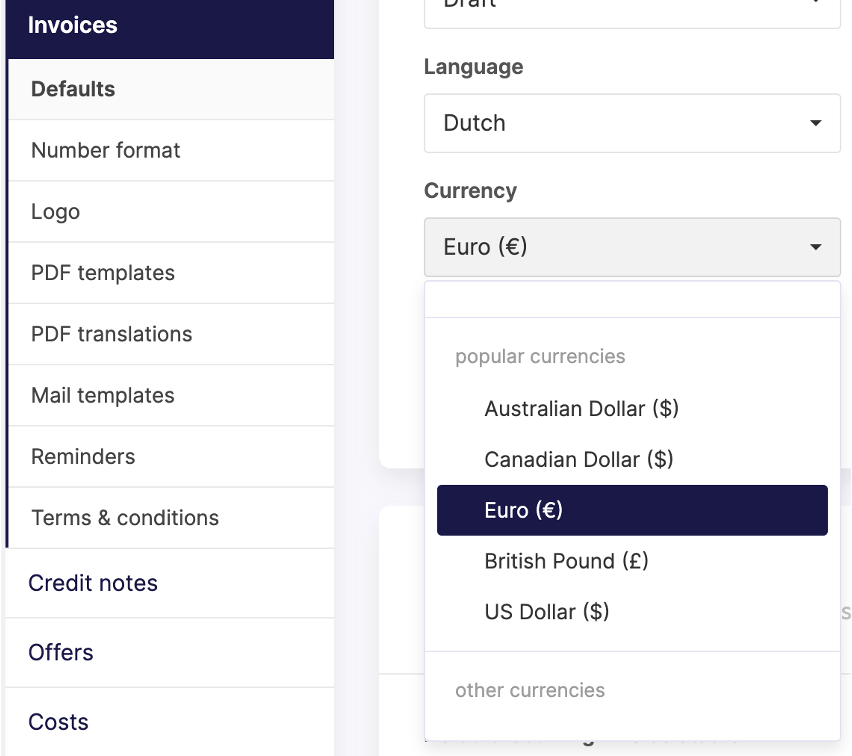

By default, you need to invoice in the currency of your country. If you use a decent invoicing program, this will be a simple setting in your account. Choose a currency once and it will be automatically applied to all your invoices.

In CoManage, for instance, you can set your default currency as follows:

The list is not limited to the most common currencies.

In fact, you can use all of these:

Bitcoin (btc)

European invoice currencies

Euro (€)

Britisch pound (£)

Bulgarian Lev (лев)

Swiss Frank (CHF)

Danish krone (DKK)

Croatian kuna (kn)

Czech koruna (Kč)

Hungarian forint (Ft)

Moldavian Leu (MDL)

Macedonian dinar (ден)

Norwegian Krone (kr)

Polish Zloty (PLN)

Romanian Lei (L)

Serbian dinar (дин)

Swedish Krona (kr)

Russian ruble (₽)

North-American invoice currencies

Canadian Dollar ($)

US Dollar ($)

Netherlands Antillean Guilder (f)

Mexican Peso (MXN)

African invoice currencies

Botswana Pula (P)

Algerian Dinar (DA)

Rwandan Francs (R₣)

Asian invoice currencies

Chinese Yuan Renminbi (¥)

Israeli new shekel (₪)

Indian Rupee (inr)

Jananese yen (¥)

South Korean won (₩)

Qatari Riyal (QR)

Turkish lira (try)

South-American invoice currencies

Argentinian Peso (ARS)

Bolivian Boliviano (BOB)

Brazilian Real (BRL)

Belize Dollar (BZD)

Chilean Peso (CLP)

Colombian Peso (COP)

Costa Rica Colon (₡)

Guatemalan Quetzal (GTQ)

Guyana Dollar (GYD)

Honduran Lempira (HNL)

Peruvian Sol (PEN)

Suriname Dollar (SRD)

Venezuelan Bolivar (VEF)

Australian invoice currencies

Australian Dollar ($)

Even if you picked one of the above as your default invoice currency, you can easily use any of the others on an invoice.

If you are, for example, a freelancer from Poland and you want to invoice a customer from the UK in pounds sterlings, that is possible in CoManage.

Handy, and it gets even better…

How to assign a default foreign currency to a customer?

If your invoice tool has a built-in customer database, you can normally configure the default currency per customer. Every time you create an invoice for a customer, you will automatically include the proper currency.

Please mind: if you load prices of products or services on your invoice in CoManage, you may need to adapt these.

Let’s say that you normally charge 250 euros for a logo design. You created one for a Canadian company. The difference can be huge.

Exchange rate Canadian dollar vs euro. Img source: Google

This is how easy it is to change your invoice currency in CoManage:

Final notes on foreign currencies

If your business is established in a zone with a globally accepted currency, you are in luck. Invoicing in US dollars or Euro alone can expand your market tremendously.

That is a whole different story when the currency of your country is less popular abroad.

In all cases, before you invoice in a foreign currency, talk with your accountant first. Figure out your obligations and possible limitations.

Make a clear agreement with your customers in advance so that both parties are protected from huge changes in currency exchange rates.

When you have done all of this, make sure you use an invoicing tool with your currency as well as foreign currencies. And on top of that: make sure you can easily create invoices with it in the language of your choice.