E-invoicing mandatory in Europe? - Prepare for the upcoming years

In the upcoming years, e-invoicing will become mandatory for European companies. What does that mean for you as a small or medium-sized business owner, self-employed individual, or freelancer? Here are 7 questions and answers.

Feel free to click on any of the 7 questions about e-invoicing in Belgium and Flanders to immediately read the answers.

1. What does e-invoicing mean?

E-invoicing stands for electronic invoicing. In practical terms, this means that outgoing and incoming invoices are created, sent, and received digitally.

Digital invoicing, which is also used synonymously with e-invoicing, puts an end to the era of printing invoices and sending them by mail to your customers or delivering them to your accountant.

Finally.

We are currently living in the digital age, and everyone by now knows that the "e" in email stands for electronic. It's the same with e-invoicing. Furthermore, English is the predominant language among EU member states.

What does the European Union have to do with how you as a business owner will have to send your invoices in 2025?

Perhaps more than you might initially think...

2. Is e-invoicing mandatory in the EU?

E-invoicing is a large-scale project of the EU. Each member state determines how far it goes with this and when it becomes legally mandatory. Belgium is far from a European leader in this regard. Here you will find a tabel in which you can see how far every European country is. (Last update: october 2023)

Country | e-invoicing for all government contracts | e-invoicing B2B |

|---|---|---|

Austria | Since april 2020 | No set date |

Belgium | March 2024 for all contracts | January 2026 |

Bulgaria | No set date | No set date |

Croatia | July 2019 | No set date |

Cyprus | April 2019 | No set date |

Czech Republic | April 2019 | No set date |

Denmark | Since 2005 | Probably January 2026 |

Estonia | April 2019 | No set date |

Finland | April 2021 | Probably 2028 |

France | July 2024 | January 2026 |

Germany | April 2024 | January 2026 (phased) |

Greece | January 2025 (phased) | No set date |

Hungary | No set date | No set date |

Iceland | Since 2019 | No set date |

Ireland | No set date | No set date |

Italy | Since 2014 | January 2019 |

Latvia | January 2025 | January 2025 |

Liechtenstein | No set date | No set date |

Lithuania | July 2017 | No set date |

Luxembourg | March 2023 | No set date |

Malta | April 2020 | No set date |

Norway | Since 2019 | No set date |

Poland | Since 2019 | July 2024 |

Portugal | January 2024 | No set date |

Romania | July 2022 | January 2024 |

Slovakia | Q1 2024 | Probably 2025 |

Slovenia | January 2015 | Probably 2025 |

Spain | January 2015 | Probably 2024 |

Sweden | April 2019 | No set date |

the Netherlands | January 2019 | No set date |

United Kingdom | April 2020 | No set date |

For example, in Romania, e-invoicing for B2B (business to business) has been mandatory for all contracts since 2022.

By the way, B2B refers to business-to-business. We'll come back to this.

It's important for you as a business owner to know that in Europe, e-invoicing makes a distinction between who sends the invoice and who receives it. You may need to reverse the VAT.

Additionally, you will likely have to create your invoice in a foreign language.

For Belgian entrepreneurs with international ambitions, it's important to know how other EU member states are progressing in terms of e-invoicing legislation.

Finally, we should mention that EU laws often impose an additional administrative burden on businesses.

Consider, for example, EU legislation on how curved bananas can be. Absurd, isn't it?

In contrast, mandatory e-invoicing does offer real benefits for you as a business owner. Before we discuss that, let's first take a look at Belgium and Flanders' plans to implement the European e-invoicing guidelines.

What is Peppol?

Peppol (Pan-European Public Procurement On-Line) is a standardized electronic data exchange network that enables organizations to invoice and place orders electronically in a secure and reliable manner. This network facilitates communication between buyers and sellers, regardless of the software used, significantly improving the efficiency of the procurement and invoicing process.

Peppol's standardized protocols and guidelines allow companies to reduce their administrative burden, avoid errors and receive payments faster. Using Peppol is currently especially useful for companies doing business with government agencies, as many governments in Europe require the use of this network for e-invoicing.

Through the Peppol network, invoices are sent in UBL format, and that UBL format is already currently exportable through CoManage. A link to a Peppol access point is being worked on.

3. What does Belgian legislation say about e-invoicing?

In 2026, Belgian companies are supposed to switch to e-invoicing. At the moment, there is only a policy note that indicates that the government has ambitious plans for digitization.

Digital invoicing is a small part of an ambitious plan.

At this moment, the only thing that is certain is that there are a lot of questions.

As a company, the impact of e-invoicing will depend on whom you do business with.

Below, after the timeline, we provide a brief overview of the current and future situation.

Timeline of e-invoicing in Belgium so far:

October 2022 | April 2023 | March 2024 | January 2026 |

E-invoicing mandatory for government contracts over €215,000 | E-invoicing mandatory for government contracts of €30,000 or more | E-invoicing mandatory for government contracts of €3,000 to €30,000 | E-invoicing mandatory between all taxable businesses (B2B) |

B2B: Business to business

All transactions that take place between businesses must already be properly registered. The government collects VAT, and it must be on your invoices.

Now: You can still create your B2B invoices as PDFs or even send them by mail.

In 2026: B2B invoicing will have to be done digitally, as mandated by Minister Van Peteghem:

Starting January 1, 2026, all taxable B2B businesses must use e-invoicing.

There will be a broad information campaign aimed at stakeholders until then.

B2C: Business to consumer

E-invoicing is intended to curb the circulation of undeclared income. However, it's the B2C sector that has the reputation for occasionally involving under-the-table transactions.

Additionally, companies or self-employed individuals providing services or products to consumers do not always have to create an invoice.

Fortunately, at the bakery or newsstand, you don't receive an invoice.

Now: B2C invoicing can simply be a PDF emailed to you, or you can print it and send it by mail, or it can even be just a receipt.

2025: Many uncertainties:

Will the Belgian government require pure B2C businesses to switch to digital invoicing?

Will certain sectors be excluded from e-invoicing?

Will it be mandatory to provide consumers with a digital invoice above a certain amount?

Will consumers need to use a specific email address to receive digital invoices?

What about businesses that operate in both B2B and B2C? Will they have to deliver some of their invoices digitally and others not?

And what about older consumers who are not digitally savvy?

B2G: Business to government

Governments regularly rely on the private sector. This is not only for public works but can also include tasks like designing a logo for a municipality or producing a video for a province.

Now: As a government supplier, you already have to submit your invoices digitally. More information from the Flemish Government can be found on this page.

2025: There likely won't be much change in this area.

G2B: Government to business

As a business owner, you already pay bills to the government in the form of various taxes and VAT contributions.

Now: You receive these bills either by mail or digitally, such as through your accountant who calculates the VAT for you.

2025: Uncertainties

Will the government consider its own bills to businesses as invoices and handle them as such?

Will businesses need a program to receive these bills/invoices digitally?

G2G: Government to government

We mention this for completeness. As a business owner, it's nice to know that the government sets a good example. The exchange of invoices and other documents between Flemish government services is already digital.

So, there are still many uncertainties about what e-invoicing will look like in 2025 for B2C. It's not pleasant for business owners to live in uncertainty.

Fortunately, we can already answer one important question...

4. Is a PDF an e-invoice?

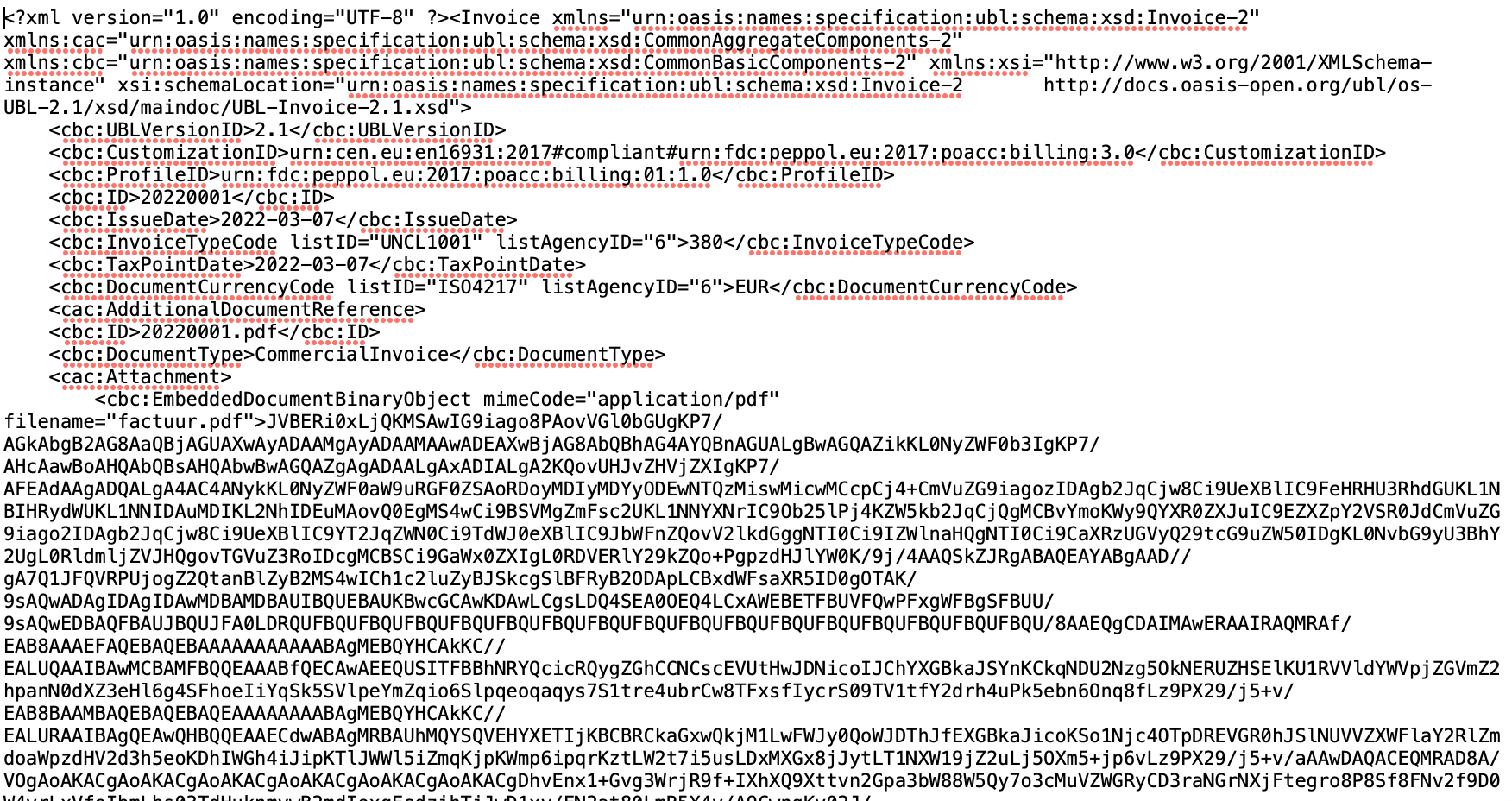

A PDF file is not an e-invoice. Digital invoices are structured with fields that must comply with the so-called UBL (Universal Business Language) standards. A PDF file does not have these fields.

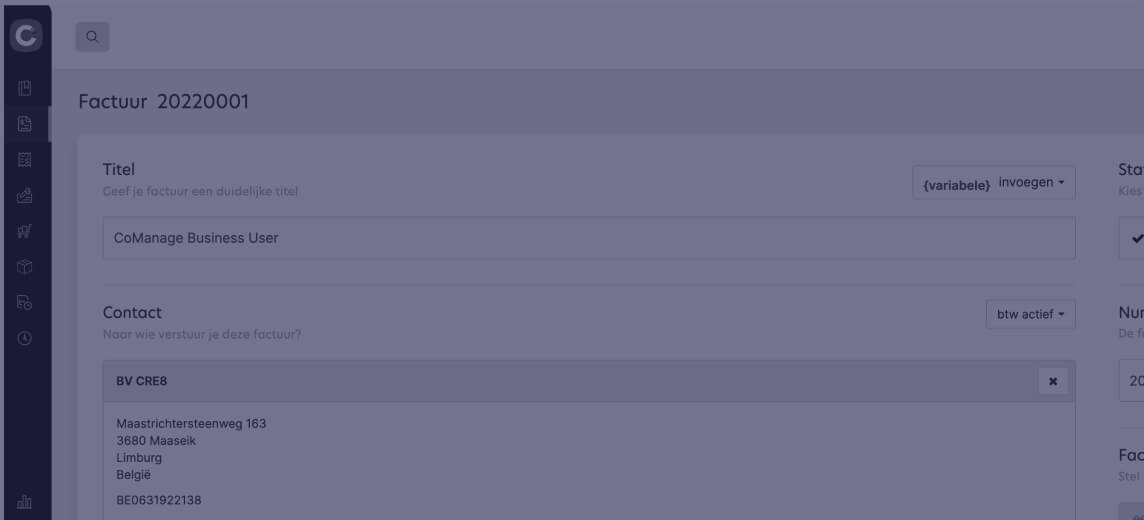

The image below gives you an idea of what a UBL invoice looks like.

The purpose of all these fields is to allow the e-invoice to be quickly and accurately read by accounting software.

If you create invoices with Word or Excel and then export them as PDFs, you do not have this information.

In other words, you have not created an electronic invoice, even though you can send a PDF by email.

In 2026, PDF invoices will no longer be allowed.

Fortunately, there are many affordable solutions for freelancers and SMEs to quickly and easily create e-invoices...

5. How can you create an e-invoice?

To create an e-invoice, you need a program that automatically converts your invoices into legally valid digital invoices. You can use either accounting software or invoicing software for this.

The difference between accounting and invoicing is significant. Incoming and outgoing invoices are only a part of accounting.

As a business owner, freelancer, or self-employed individual, it's not easy to handle accounting alongside your work. Laws change, and mistakes in your accounting can be costly.

With good invoicing software, you can create an e-invoice without extra effort.

You won't get lost in the maze of accounting software.

You can quickly and effortlessly create digital invoices yourself.

Additionally, you can be sure that these invoices comply with the legal requirements of e-invoicing.

The only question you need to answer before getting started with e-invoicing is...

6. Which e-invoicing program is right for you?

There is no one-size-fits-all invoicing program for all freelancers and businesses. Each company is unique and has specific budgets, knowledge, and needs.

For a freelancer with a few loyal major clients, an online client database may be less important than for an SME with customers across the country.

You can try out CoManage and decide if it suits you as much as it does for more than 1,500 satisfied e-invoice entrepreneurs.

Our support team is ready to help. If you get stuck, we're here to assist you, even on weekends.

There's just one more question left...

7. What are the benefits of e-invoicing for businesses?

E-invoicing offers many benefits for businesses. An organized and partially automated administration, time savings, and reduced risk of errors are just a few of them.

Invoicing programs differ in what they can offer your business.

But with a reliable program, you can at least enjoy the following benefits of a good e-invoicing program.

Effortlessly create e-invoices

Overview of all invoices and their payment status

Send invoices directly from the program

A smartphone app

Automatically send payment reminders

Copy invoices to quickly create new ones

Automatically create and send recurring invoices

CoManage can do much more than what a minimal good invoicing program can do.

Sending quotes and converting them into invoices with a single click is just one example. Feel free to check out the complete overview of all the handy CoManage features.

Or you can experience it for yourself.

14 days free, with no obligation, and a team ready to quickly answer all your questions about your e-invoices.

Conclusion: should your business wait until 2026 to switch to e-invoicing?

In 2026, e-invoicing will become mandatory in Belgium. Until then, you can choose how you create, send, and receive your invoices.

What the legislation will look like is currently unclear.

There's a possibility that large companies will be required to comply first. SMEs, self-employed individuals, and freelancers may get some leeway to switch to e-invoicing.

Additionally, it's unclear how digital invoicing between businesses, consumers, and governments will be defined by the law.

Switching to e-invoicing before 2026 is a smart strategic move

Efficient, digital business administration frees up more time for your customers and the things your business excels at.

And if you choose an invoicing program that suits your needs 100%, e-invoicing becomes child's play.